The annual global proof of work mining costs of bitcoin is $1,423,794,674.

Bitcoin alone annually consumes 28.48 TWh worth of electricity. The country of Ecuador consumed around 21 TWh!

Bitcoin consumes more power than Ireland, Bahrain, and the Slovak Republic! Holy shit!

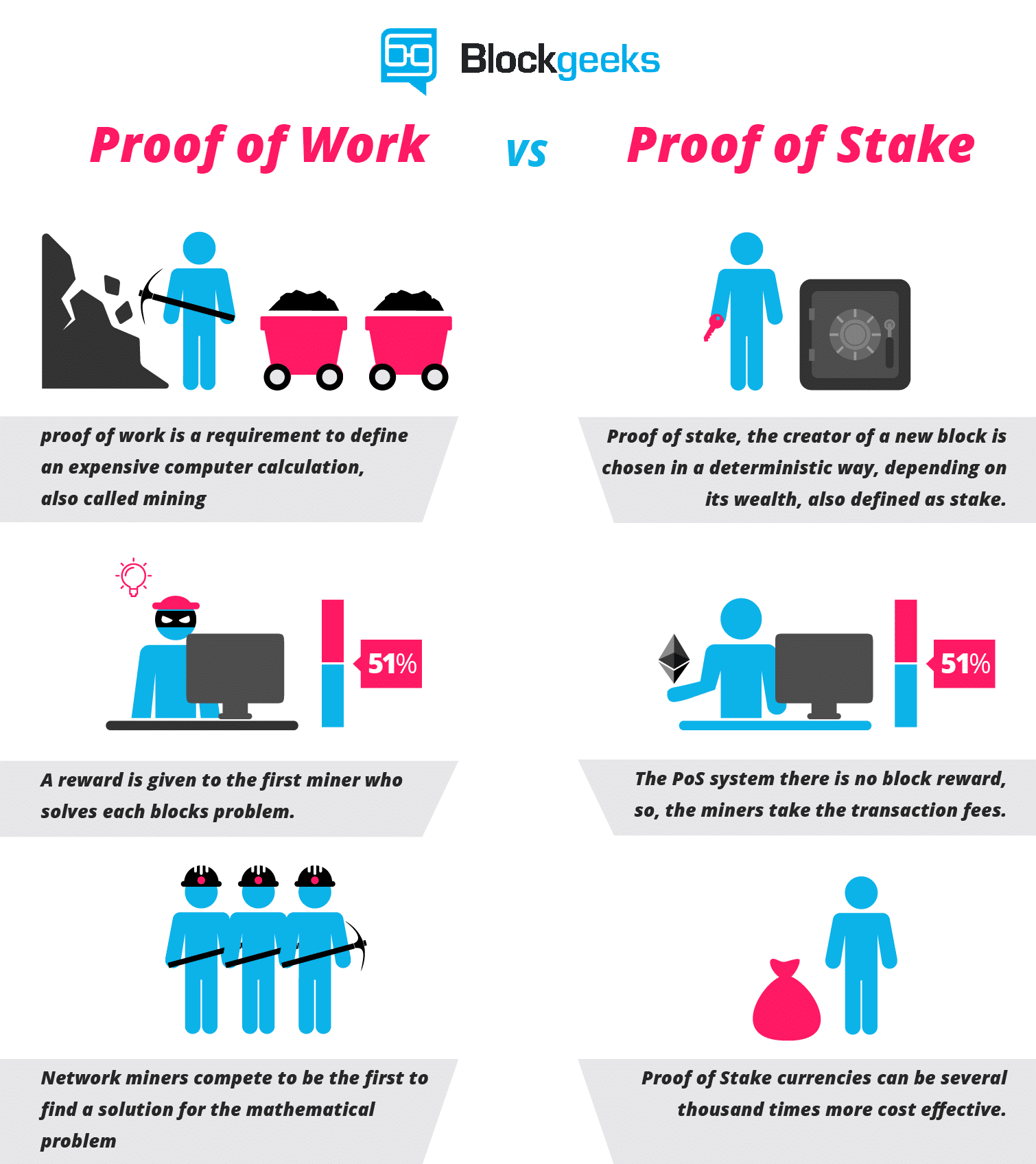

- The validators stake a portion of their Ethers as stake.

- After that, they will start validating the blocks of transactions. Meaning, when they discover a block which they think can be added to the chain, they will validate it by placing a bet on it.

- If the block gets appended, then the validators will get a reward proportionate to their bets.

- However, if a validator acts in a malicious manner and tries to do a “nothing at stake”, they will immediately be reprimanded, and all of their stake is going to get slashed.

Ok that’s a pretty rough analogy but that’s the idea. You don’t participate unless you’re acting the best interests of the network and if you try to pull a fast one and verify a fraudulent transaction to your own game, the network will shut you down and take your stake. There is a rough analogy that the more Ether you have, the more stake you can place to validate blocks and therefore the more you can make. You might think this could be gamed by owning 51% of the stake (total Ether).

Pingback: The Rise and Fall (and repeat) of Crypto | | IT Security News